The next two decades will see $124 trillion in global wealth change hands. For private banks and asset managers, this transfer requires a strategic response. The next generation of wealth holders expects digital-first communication and authentic storytelling to bring them closer to their bank.

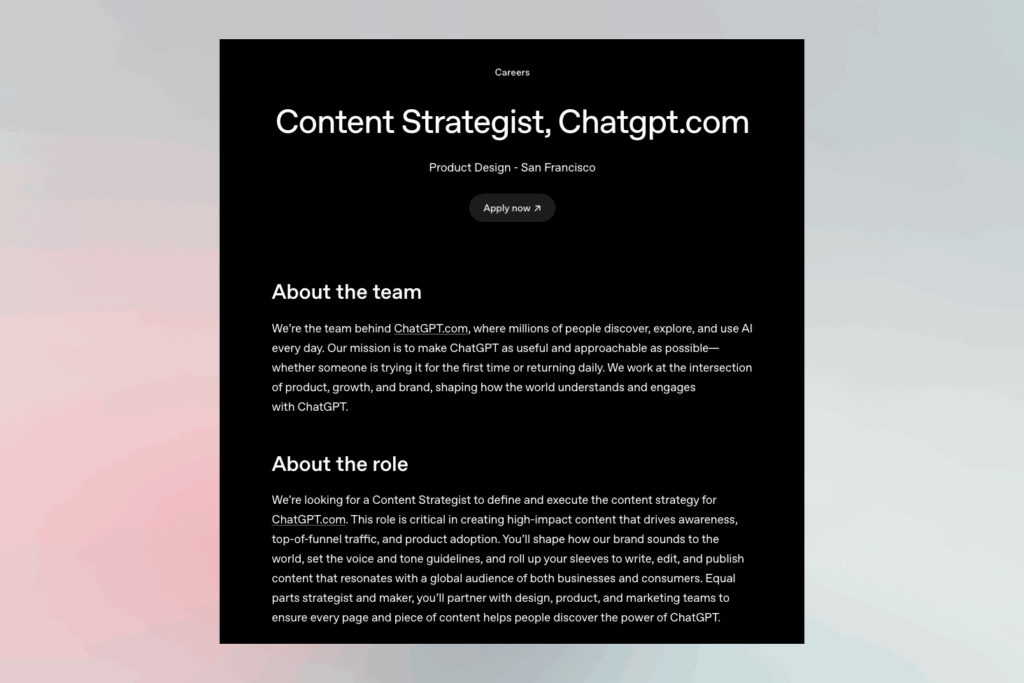

OpenAI’s recent search for a Content Strategist for ChatGPT.com reveals something crucial about this moment. The company that created the world’s most sophisticated text generation tool is actively recruiting human strategists to craft its narrative. In its quest to create content that drives measurable impact, OpenAI seeks someone with 6-10 years of experience who can define voice, understand diverse audiences, and connect storytelling to business outcomes. The AI industry’s leader is betting that strategic content creation will still require human judgement.

The Digital Native Inheritance

Today’s wealth inheritors grew up with smartphones, social media, and instant access to information. They evaluate financial institutions through websites, LinkedIn thought leadership, and digital touchpoints long before scheduling a first meeting. For Geneva’s private banks, historically built on discretion and personal relationships, this shift demands a rethinking of client engagement.

Content strategy becomes the bridge between generations. When a 35-year-old entrepreneur inherits a portfolio managed by their family’s bank for three generations, the institution’s ability to communicate value in contemporary terms determines whether that relationship continues. Technical expertise alone no longer suffices. Banks must articulate their relevance through narratives that resonate with modern values around impact investing, sustainability, and purpose-driven wealth management.

Beyond Automation

The OpenAI job posting requires someone who can “define and evolve ChatGPT’s voice and tone across owned web surfaces.” This emphasis on voice reveals what automated content generation cannot achieve: the understanding of audience psychology, cultural context, and strategic positioning that defines effective communication.

For financial institutions, this distinction matters. While AI tools can generate market commentary or portfolio updates, they cannot craft the narratives required to navigate family dynamics during wealth transitions. They cannot anticipate the concerns of a widow managing her late husband’s estate for the first time. They cannot build the trust that emerges from consistent, contextually appropriate communication.

The Strategic Imperative

The most effective content strategies create multiplier effects. When a Geneva bank publishes research on family office evolution, it builds institutional reputation. That same research fuels demand-creation campaigns targeting family offices, provides educational webinar content, and gives relationship managers substantive reasons to reconnect with prospects. One strategic investment yields four distinct returns.

OpenAI seeks strategists who understand this interconnection—professionals who can “align content to growth, acquisition, and product goals” simultaneously. Financial institutions need the same holistic thinking, where every piece of content strengthens multiple business objectives rather than serving isolated purposes.

Measuring What Matters

Traditional metrics like assets under management tell only part of the story. Institutions now track content engagement as a leading indicator of client retention and acquisition. They monitor which topics resonate with different client segments, how content consumption correlates with account growth, and where digital touchpoints strengthen or weaken relationships.

The data reveals patterns. Clients who engage with a bank’s content are more likely to consolidate assets, refer new business, and transition wealth to the next generation. Content becomes a strategic asset that drives business outcomes.

Building for Tomorrow

Geneva’s position as a wealth management hub depends on its ability to evolve with changing client expectations. The institutions that succeed will recognise content strategy as core to their value proposition, not an afterthought delegated to marketing departments.

This requires senior leadership to champion content initiatives, allocate resources, and establish accountability for results. It means building internal capabilities while partnering with specialists who understand both financial services and modern communication dynamics. Content strategy compounds over time, building authority and trust through consistent excellence.

The great wealth transfer represents a defining moment for private banking. The institutions that master strategic content creation will forge relationships with the next generation of wealth holders. Those that rely on traditional approaches or automated solutions risk watching their client base age out of existence. OpenAI’s recognition that even advanced AI requires human content strategists should serve as both validation and warning for Geneva’s financial community. The future belongs to those who can tell their story with precision, authenticity, and strategic intent.